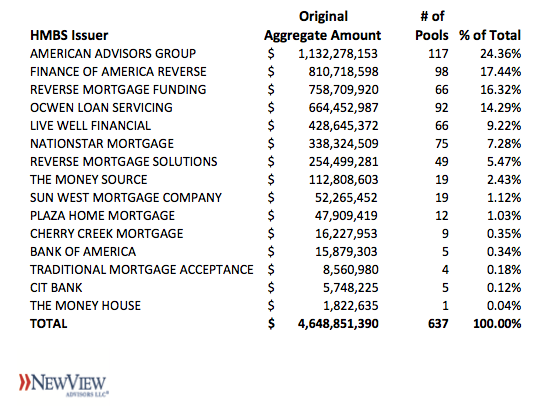

AAG remains the leading HMBS Issuer for the first half of 2017, issuing $1.132 billion of securities for a 24.4% market share, increasing by 0.42% from the first quarter its margin over #2 Finance America Reverse’s $810.7 million and 17.4% market share. Reverse Mortgage Funding remained in third for the half with $758.7 million issued and 16.3% market share. Ocwen Loan Servicing and Live Well Financial round out the top five issuers. Ocwen issued $664.4 million for a 14.3% market share, and Live Well was fifth with $428.6 million issued for a 9.2% market share. Nationstar dropped to 6th place for the half. The top five issuers accounted for 81.6% of all issuance, up from last quarter’s 79.6%. There were 15 HMBS issuers in the first half of 2017, tying the high water mark for number of issuers set in 2016.

Despite the much-reported slowdown in HECM endorsements, HMBS issuance remains robust, aided by growth in tail issuance and without highly seasoned pools. Issuance volume totaled $4.649 billion for the first half of 2017, on pace to pass 2016’s full year production of $9.187 billion. 2010 was the record year for HMBS with $10.7 billion of securities issued.

New View Advisors compiled this data from publicly available Ginnie Mae data as well as private sources.